So, why does net worth explode after you’ve saved your first $100,000? Today we’re going to take a look at that, so stay tuned and find out why.

I want to dive into the reasons why net worth explodes after you’ve saved your first $100,000. To be honest with you, I didn’t really buy into this belief for a very long time.

Here’s the big reason. I had accumulated more than $100,000 on two other occasions in the past. But my problem was I also hadn’t learned that wealth mindset that goes along with saving that amount.

Now, this is important. Why? On both occasions, I, in my opinion, won the lottery in life. One, by inheritances, and the second by a stroke of luck in business, to be honest with you.

But in neither instance did I have to work super hard to get that $100,000 saved up. But let’s start today by saying the following. One, consider what saving will make of you when you’ve saved that first $100,000.

It’s a bit of a tongue twister, but I want you to pause and just think about it. I think what makes the difference above all else is you do need to sweat a bit, so to speak, to earn that amount. And I believe that will dramatically increase your net worth after you save that first $100,000.

And the biggest difference is you’ll have a greater desire not to spend those savings, but to rather accumulate those savings once you’ve gained this very important wealth mindset. Hence, why saving that first $100,000 has been quoted by many as one of the toughest hills to climb. When I approached saving to this first platitude, I wanted it really badly.

I didn’t want to wait 10 years or five years. Heck, I didn’t want to wait a year. But that was too fast, unfortunately.

And it did take me about a year to year and a half to reach this first goal. Then I had an unfortunate accident occur that caused me to have to spend about $40,000 of money I was preparing to add to these savings. It was actually kind of dog-eared in my emergency fund at the time.

For me, this was a huge setback. I had a hope to accomplish saving my second $100,000 in under one year. But the important thing was that mindset was definitely in place, for me at least.

And preserving this initial capital was paramount to me. Above all else, touching this initial $100,000 I’d saved was to be avoided at all costs. The second point is, you will just naturally become a better investor.

It will just happen because you will want to get the greatest returns on your cash as possible without gambling with them. This will happen when you’re saving your first $100,000 as well. Regardless of whatever vehicles you use to get there, you’ll gain valuable experience in investing by going through the ups and downs that will just occur.

When I first started out, my initial investment knowledge extended to knowing how to invest into good dividend stocks from good and solid companies. Companies like the utility company, the banks, Coca-Cola. I think you get the idea.

Basically, companies that I could see the brands that I used every day. Also, I watched a lot of YouTube videos and read a lot of books. I could have stopped there and continued to do well.

I knew though that I was making gains in two areas when investing into stocks. The first one is the increase in stock price and the second is in stock dividends. I also knew I needed to build a base that would provide a long-term reliable monthly income to me because I would need to begin to need to take from these resources within the next 10 years.

This led me to discovering exchange-traded funds or they’re also called ETFs. ETFs are basically baskets of stocks that are related in some manner. For example, the stocks in the basket could be all the stocks in the S&P 500 or it could just be utility companies.

There’s lots of different options. What makes ETFs attractive though is the fact that they have very low management fees and potentially high dividend returns. Another strong factor is many of them will pay a monthly dividend which fits well with harvesting funds from the accounts on a regular basis.

With conventional stocks, I could see potential returns that hovered around four to five percent. From half to most of the gains though was through stock appreciation though which can be very unpredictable. Many retirees get wiped out in the first years of retirement because of long-term downward market swings and to me that’s just way too much personal risk in my opinion.

Again, because I’m relying on the dividend only on the ETFs, the price can go up, they can go down but I honestly don’t care. As long as the dividend stays consistent then all is good in the land. I know that the price of an ETF over time will eventually climb or at least stay within a range of prices and I won’t be put into a position to sell the shares to make up a loss in price that I’d be depending upon for my monthly expenses.

Also, it’s important to realize that ETFs can return seven percent or more. Building a portfolio of ETFs can easily set you up to receive between 10 to 14 percent constant dividend returns and this is excellent. It’s actually a little bit of unheard of in the market but it works.

Third point, more invested cash provides more returns and this is one of the reasons why you start to see this explosion happening after you’ve hit your first 100k. This is simply something that shouldn’t be missed or understated. When you’re making 10% on $10,000 it works out to a return of about $1,000 a year or only $83 a month and that, hey, let’s be honest, that’s not very exciting.

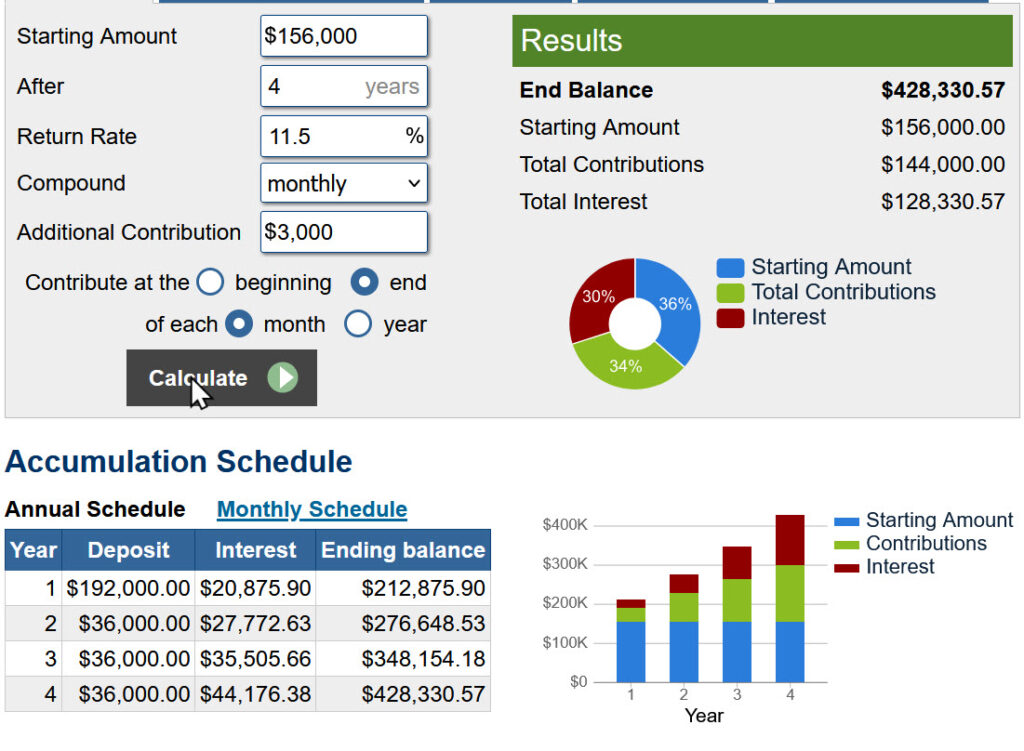

But now let’s say you’ve saved that first 100k, you’ll now receive 10 times that return or $833 per month. Now things are getting interesting and every $100,000 you add to this initial amount will multiply this dividend amount. Personally, in my portfolio I’ve saved over $150,000 and I receive about $1,375 in dividends per month because I’m averaging an 11% rate of return.

I do hope to boost this in the next six months to get it closer to that 14%. So as time passes and your balance increases, you will notice a definite increase in your monthly dividend returns and that’s pretty exciting. It can be so exciting that the fund can literally fund itself at some point and that leads me to my next point.

Number four, compound interest really starts to kick in after $100,000. Again, why does everything explode after 100k? Let’s say you’re trying to save your first $100,000 and you’re starting from zero. You’ve committed yourself to putting in $1,000 per month into your savings and you’re getting a return rate of let’s say 10%.

If you stick to this plan, you’ll have your first $100,000 saved in approximately six years. Most of the savings, which is $73,000, you had to contribute and almost $27,000 came from interest. Not too shabby, but it can be better.

Your second $100,000 will be a tad faster. Using the same criteria, except that you have your first $100,000 already saved, it will only take you 3.8 years to double your savings. Why? In this scenario, you’ve contributed another $45,000 but compound interest has taken over and contributed almost $55,000.

Yes, it’s true. Interestingly enough, your third $100,000 for a total of $300,000 will only take another 2.7 years. And again, this is true.

The numbers work. Your compound interest will account for two-thirds of this gain. So as you can see, the time it takes to go from your initial $100,000 to $200,000 and beyond will become faster and faster and faster.

Again, it’s that first $100k that takes the longest. Point number 5. You will find that in all areas of your life, you will become positively influenced. This final point reflects much of what saving that first $100,000 will do to you.

You will more than likely find that your overall net worth increases substantially during this same time period. For example, I did my homework when I came and moved into the house we bought. I looked at the market with what knowledge I had and came to some conclusions.

Now, just three years later, our house value has escalated close to 50%, which is actually unheard of, but it has happened. The overall market is pretty hot in the Calgary, Alberta region, but even our rise in value is above other local markets by as much as 20%. This has permitted my net worth to grow to increase by another 250,000 years in two years, and it all came because I looked for a certain criteria when I was going to buy this house, and it came through research and knowledge, and it helped me and guided me to the house that I purchased.

Plus, I’ve narrowed my efforts to maximize results. Our monthly expenses are much less, and my wage base has significantly increased. Put it all together, and it’s permitting me to save close to $3,000 a month now, in comparison to the meager $500 I used to contribute three years ago.

Again, all these things came into focus as I began to build the necessary wealth mindsets as I saved the first $100,000. Now, I’m confident that over the next five to ten years, I should be able to save my first million dollars. As little as five years ago, this was just a pipe dream and definitely not a reality.

Today, I can see it happening. So, that’s why I believe your net worth explodes after your first $100,000. It’s just not the $100,000 that’s important.

It’s all the timely wealth mindsets that are developing in your mind. And I think, really, that’s the biggest takeaway. And a very quick bonus for you.

If you’re still here, you’re going to get this awesome bonus. Something else will likely happen to you as well. You’ll find that you put your hand to activities and ventures that could generate secondary streams of income, which again will boost your cash collection effort.

Myself, I take some of my precious time and invested it into understanding the technology I’m currently using in my day work to build dynamic SAAS or software as a service businesses. None of them has to generate much, but collectively, it can really, really add up over time. Also, my efforts on YouTube can’t be understated.

Right now, it doesn’t generate any income, but there will come a day when it will. This effort on its own has the potential to completely replace my current salary. Don’t give up hope.

A smart man once said, there are two times in life to plant a money tree, 20 years ago and today. If you didn’t plant it 20 years ago, start digging and get it planted today. Start building those wealth mindsets.